Laptop tax depreciation calculator

Computer and laptop depreciation rate in Australia is calculated by the computer and laptop. This limit is reduced by the amount by which the cost of.

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculator as per Companies Act 2013.

. While all the effort has been made to make this. Depreciated for the regular tax using the 200 declining balance method generally 3 5 7 or 10 year property under the modified accelerated cost recovery system MACRS. TaxAdda Private Limited CIN - U93000RJ2019PTC067547 GSTIN - 08AAHCT6764E1Z1.

When an asset loses value by an annual percentage it is known. ATO Depreciation Rates 2021. Depreciation asset cost salvage value useful life of asset.

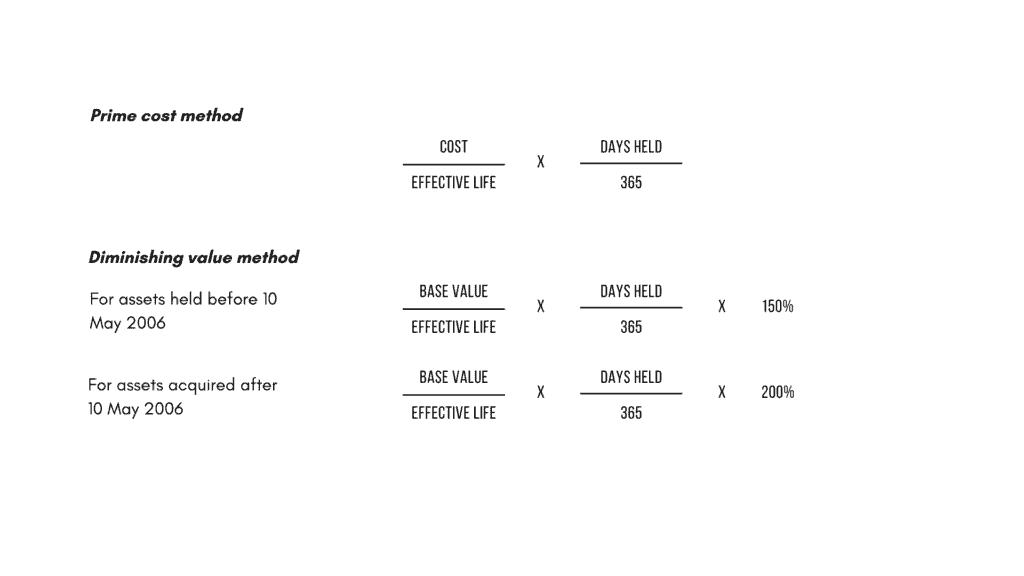

You can claim a deduction for the decline in value of a depreciating asset over the effective life of the asset where the asset either. Straight Line Depreciation Method. The formula to calculate annual depreciation.

This depreciation calculator will determine the actual cash value of your Computers using a replacement value and a 4-year lifespan which equates to 004 annual. For laptops this is typically two years and for desktops typically four years. Section 179 deduction dollar limits.

Please resend the purchase document of the laptop along with the letter from the company stating that you use the laptop 100 for work purposes when sending the calculation. Find the depreciation rate for a business asset calculate depreciation for a business asset using either the diminishing value. MCGs Quantity Surveyors patented Tax Depreciation Calculator is the first calculator which provides representation of accurate estimates through actual real properties.

Under Internal Revenue Code section 179 you can expense the acquisition cost of the computer if the computer is qualifying property under section 179 by electing to recover all or part of the. He plans to sell the scrap at the end of its useful life of 5 years for 50. éÆGVÆ Ôø å u2½t¹ D _Øi4HÏÏL9QðÅýòäÜšpçÌïKÚPÚ ˆPÚ ³E¼âI_kP VÔ ¼ZfÍžùÝ xÇ DœÜm2 1 Ç xÝV À œTM 6n eTljø³ ÈËdEuÞx7 EìZpÿ Ë.

Beranda Calculate depreciation laptop tax. Cost more than 300 forms part of a set that together cost. If your computer cost more than 300 you can claim the depreciation over the life of the equipment.

It lets you work. Depreciation rate finder and calculator You can use this tool to. The four most widely used depreciation formulaes are as listed below.

The tool includes updates to reflect tax depreciation. Mobileportable computers including laptop s tablets 2 years. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. In the example 520 minus 65 equals 455. You can use this tool to.

If your purchase was more than 300 you can claim depreciation expense. Calculate the annual depreciation Ali should book for 5 years.

How To Calculate Depreciation On Computer Hardware A Cheat Sheet Techrepublic

How To Save Money With A Small Business Tax Deductions Checklist 2021 Insureon

How To Calculate Depreciation On Computer Hardware A Cheat Sheet Techrepublic

You May Be Able To Deduct Some Ccrc Costs From Your Taxes Mylifesite

Depreciation Formula Calculate Depreciation Expense

Macrs Depreciation Calculator With Formula Nerd Counter

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Schedule Template For Straight Line And Declining Balance

How To Calculate Depreciation Legalzoom

Working From Home During Covid 19 Tax Deductions Guided Investor

How To Calculate Depreciation Know Your Assets Real Value

The Best Method Of Calculating Tax Depreciation Koste Chartered Quantity Surveyors

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Formula Calculate Depreciation Expense

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Rate Formula Examples How To Calculate

Asset Depreciation Getting The Most Back On Your Tax Return